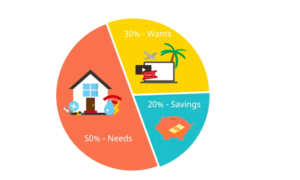

50/30/20 rule and provide some additional insights:

Thank you for reading this post, don't forget to subscribe!1. Needs (50%):

– This category covers essential expenses that are required for your basic well-being and daily life.

– It includes housing costs (rent or mortgage), utilities (electricity, water, gas, internet), groceries, transportation (commuting costs), insurance (health, auto, home), and minimum debt payments.

– It’s important to carefully evaluate your needs and look for opportunities to reduce costs. For example, you might consider refinancing your mortgage, carpooling to save on transportation expenses, or shopping strategically for groceries.

2.Wants (30%):

– The wants category allows for discretionary spending on things that enhance your lifestyle and provide enjoyment.

– This can encompass dining out, entertainment (movies, concerts, streaming services), travel, shopping for non-essential items, hobbies, and recreational activities.

– While this category provides flexibility for enjoyment, it’s also important to keep it in check to avoid overspending. Setting a monthly spending limit within this category can be helpful.

3. Savings and Debt Repayment (20%):

– The savings and debt repayment category is critical for building financial security and planning for the future.

– It includes savings for emergencies (an emergency fund), retirement savings (such as a 401(k) or IRA), investments, and paying down debt (especially high-interest debt like credit card balances).

– Prioritizing this category can help you achieve long-term financial goals, reduce debt, and build wealth over time.

Additional Tips:

– Be flexible: The 50/30/20 rule is a guideline, not a strict rule. Adjust the percentages to align with your unique circumstances and goals.

– Review and adjust regularly: As your financial situation changes, review and adjust your budget accordingly. This ensures that your money is working in the most effective way to meet your evolving needs.

– Emergency fund: Building an emergency fund within the savings category is crucial for financial stability. It can cover unexpected expenses without disrupting your budget.